Two-pot retirement system

Withdrawals, fees, & tax implications

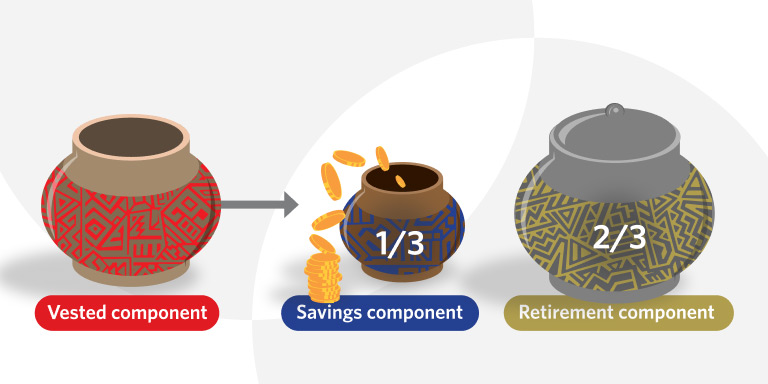

The two-pot retirement system focuses on providing greater flexibility for you in an emergency while balancing your long-time retirement savings. Here is some helpful information:

- Our simplified guide explains plainly what the two pot retirement system is.

- Before you withdraw, read about withdrawal fees and tax implications.

Savings component calculator

When the two-pot retirement system comes into legislation on 1 September 2024, you can withdraw from your savings pot in case of emergencies. However, it's usually better to keep this money invested - if you don’t withdraw, you’ll have more savings by the time you retire than if you do.

Use our savings component calculator to see how your savings could grow if you keep them invested. It will help you understand the potential benefits of leaving your money invested.

What is the two pot retirement system?

From the proposed date of implementation on 1 September 2024, the two-pot system will change the future of retirement planning in South Africa.

Here's what you need to know:

Why is the two-pot retirement system important

- The two-pot system can help you save more for retirement, protect your retirement savings, and make better retirement planning decisions.

- The savings component gives you access to some of your retirement savings in an emergency. This can help you avoid dipping into your retirement savings too early, which can reduce the amount of money you have available when you retire.

- The retirement component is locked away until you retire. This helps protect your retirement savings from being accessed too early or lost due to financial hardship.

Need help?

There are a few ways to get in touch with us. Choose a channel that works best for you.